Get the free form e 1

Show details

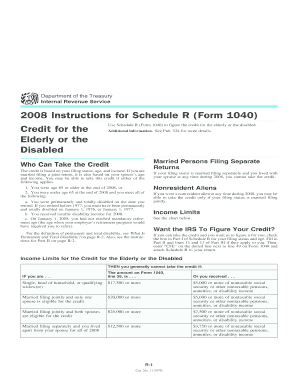

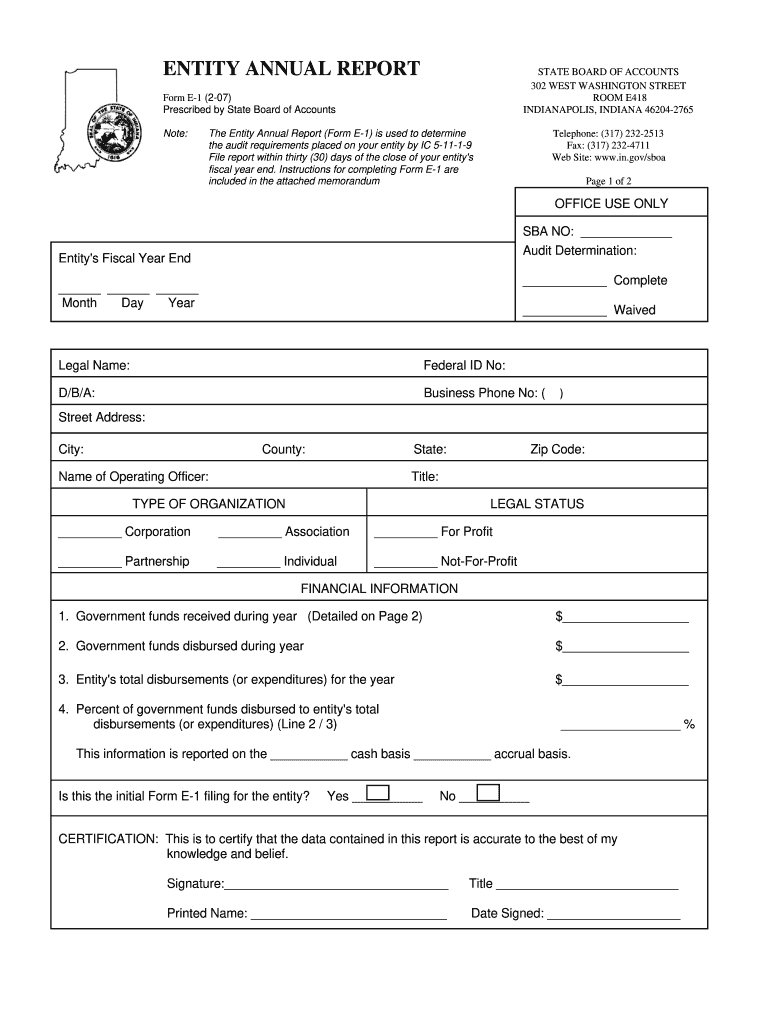

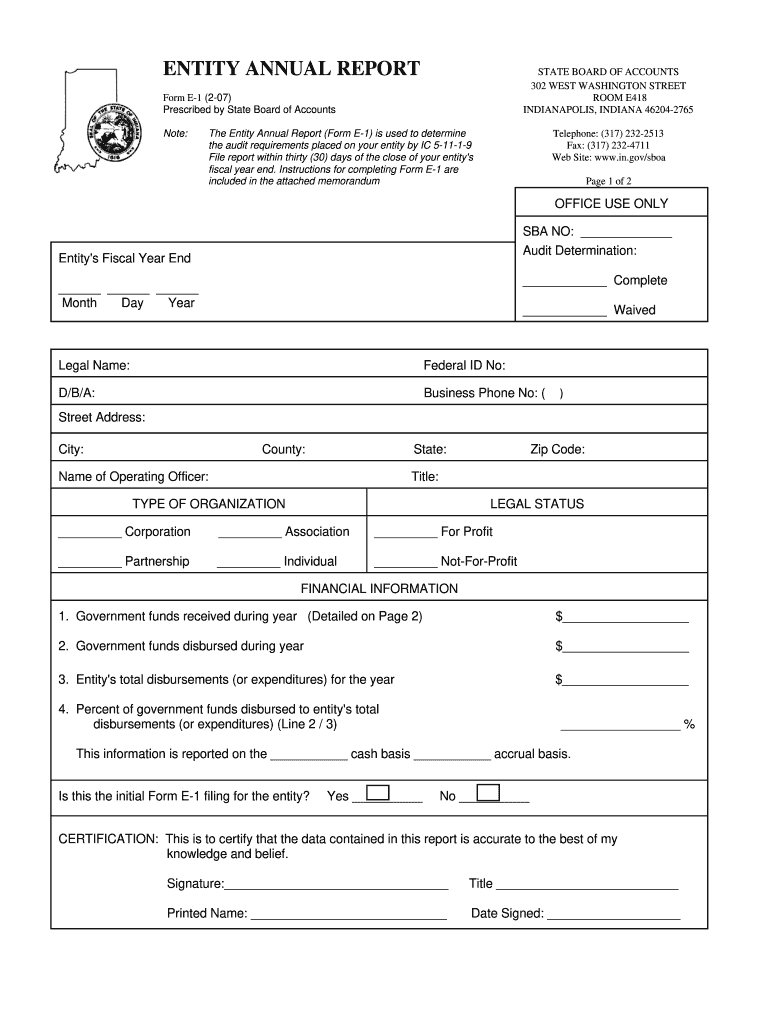

ENTITY ANNUAL REPORT STATE BOARD OF ACCOUNTS 302 WEST WASHINGTON STREET ROOM E418 INDIANAPOLIS INDIANA 46204-2765 Form E-1 2-07 Prescribed by State Board of Accounts Note The Entity Annual Report Form E-1 is used to determine the audit requirements placed on your entity by IC 5-11-1-9 File report within thirty 30 days of the close of your entity s fiscal year end.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indiana entity annual report form e 1

Edit your form e 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form e 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form e 1 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form e 1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form e 1

How to fill out form e 1:

01

Begin by gathering all required information, such as personal details, employment information, and any supporting documentation.

02

Carefully read the instructions provided with the form to ensure that you understand each section and any specific requirements.

03

Start filling out the form by entering your personal information, such as your full name, date of birth, and contact details.

04

Proceed to provide the necessary employment information, such as your current job title, employer's name and address, and the duration of your employment.

05

If applicable, provide any additional information or documentation required for specific sections of the form. This may include details about dependents, previous employment history, or tax-related information.

06

Double-check all the information you have entered to ensure accuracy and completeness.

07

Sign and date the form, as required.

08

Submit the completed form e 1 as instructed, following any additional submission requirements if applicable.

Who needs form e 1:

01

Individuals who are filing for a specific purpose or benefit that requires the submission of form e 1, such as applying for a visa or work permit.

02

Employers who need to complete form e 1 for their employees as part of the hiring or employment process.

03

Government agencies or organizations that request individuals to provide form e 1 for record-keeping or statistical purposes.

Fill

form

: Try Risk Free

People Also Ask about

Does St. Louis have income tax?

In addition to the state tax, St. Louis and Kansas City both collect their own earning taxes of 1%. Residents and anyone who works in either city must pay this tax.

Who has to pay St. Louis earnings tax?

Anyone with a permanent address in the City of St. Louis will be required to file on 100% of their earnings. College students who attend school outside the city but maintain a permanent address in the City of St. Louis are required to file on their earnings.

What is an E 1 form?

Form E-1 is a tax return used by a resident individual taxpayer, regardless of the location of their employer, or a non-resident working in the City of St. Louis to file and pay the earnings tax of 1% due and not withheld by the employer. Publication Date: 03/24/2022.

What is the City of St. Louis business earnings tax?

All businesses located in the City of St. Louis, except those exempted by law, are required to pay the earnings tax of 1% of the business's earnings.

What is St. Louis City 1 earnings tax?

The City of St. Louis imposes a 1% earnings tax on salaries, wages, commissions, and other compensation earned by resident individuals of the City and by nonresident individuals of the City for work done or services performed or rendered in the City.

Who has to file a St. Louis City tax return?

Residents of the City of St. Louis, regardless of the location of their employer. Employees of businesses located or performing work/services within the City of St. Louis, regardless of where they live.

How does St. Louis City tax work?

The City of St. Louis imposes a 1% earnings tax on salaries, wages, commissions, and other compensation earned by resident individuals of the City and by nonresident individuals of the City for work done or services performed or rendered in the City.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the form e 1 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your form e 1 in minutes.

How do I fill out form e 1 using my mobile device?

Use the pdfFiller mobile app to fill out and sign form e 1. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I fill out form e 1 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your form e 1. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your form e 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form E 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.